TFSL operates as a business correspondent partner for major banks and financial institutions across India, adopting varying service delivery models to meet both the end-clients’ requirements and specific business needs of the financial partners. Out of these, two of the most successful are the Small Business Loans (SBL) and Joint Liability Group (JLG) models – TFSL assesses the credit requirement of the SBL/JLG members and evaluates their credit history, historical and current cash flows, as well as the sustainability of their ongoing economic activities.

product and business mode

Joint Liability Group

TFSL provides collateral free loans to its clients by aggregating them into groups of homogenous nature and socio-economic back ground. TFSL acts as a bridge between banks and the clients along with mitigating the credit risk by way of ensuring right group dynamics, peer pressure and center discipline.

Small Business Loans

TFSL provide secured loans to small businesses as well as other entities engaged in income generation activities mainly facilitating needs like small equipment purchase, business expansion, new business start-up and working capital requirement etc. The purpose of this loan is to serve small business, self-employed segment, manufacturers, services, which require financial support for growth and advancement of their businesses.

DAIRY LOANS (CATTLE FINANCE)

TFSL is facilitating dairy & animal husbandry industry through a joint venture with Dairy companies, facilitating small entrepreneurs/farmers to increase the milk production by providing them small & mid-sized ticket secured loans, with a hypothecation of Cattle and Charge / mortgage creation on agriculture land as collateral for the loan. While the Cattle Loan helps the farmers/small entrepreneurs to increase the production of milk to be supplied to the Dairy, the dairy in turn benefits from the milk supplies from varied sources, helping them to maintain a balance between quality of milk and the price of procurement.

In cities like Bulandshahar and Gajraula in UP, TFSL has successfully provided loans to more than 150 farmers through Partner Bank under Cattle Finance business with proper due diligence. TFSL is looking forward to expand its operations in Cattle Finance business to other states in the coming days.

OPERATIONAL UPDATES

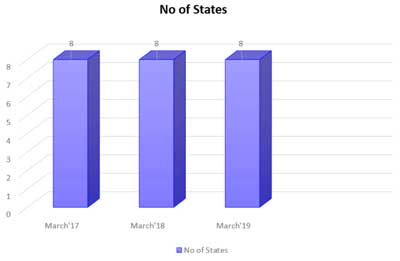

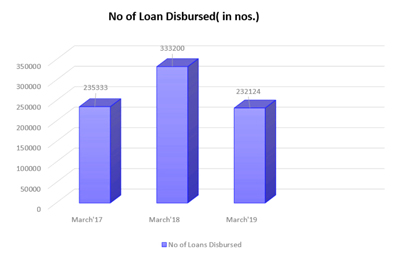

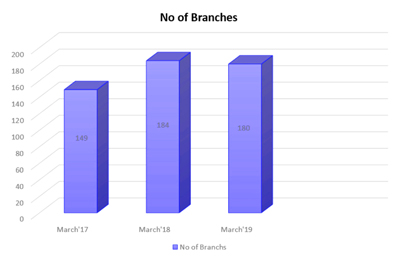

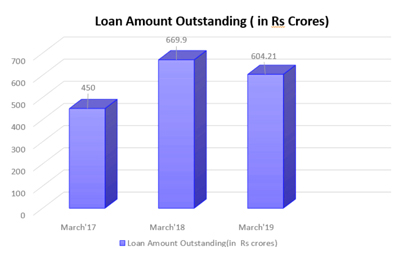

| TFSL’s progress over the years | |||

|---|---|---|---|

| Particulars | March’17 | March’18 | March’19 |

| No. of Branches (in nos.) | 149 | 184 | 180 |

| No. of States (presence in nos.) | 8 | 8 | 8 |

| No. of loans disbursed (in nos.) | 2,35,333 | 3,33,200 | 2,32,124 |

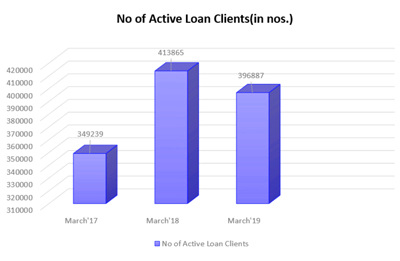

| No. of active loan clients (in nos.) | 3,49,239 | 4,13,865 | 3,96,887 |

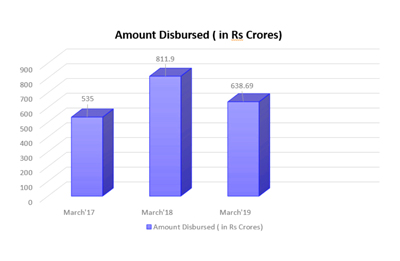

| Amount Disbursed (In Rs. crores) | 535 | 811.9 | 638.7 |

| Loan amount outstanding (In Rs. crores) | 450 | 669.9 | 604.2 |